Two Types of Alternator Key Alternator Types Explained for Efficient Power Solutions

- Introduction: Understanding the Two Types of Alternator

- Technical Advantages and Performance Metrics

- Manufacturers Comparison: Data-Driven Insights

- Customized Solutions for Various Industries

- Application Cases: Real-World Usage Scenarios

- Maintenance and Optimization Strategies

- Conclusion: Future Trends in Alternator Types

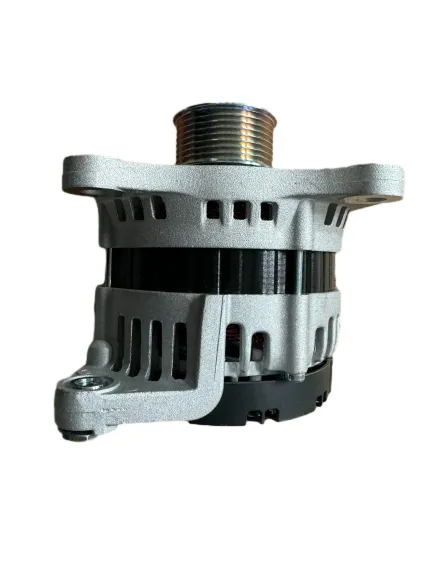

(two types of alternator)

Introduction: Exploring the Two Types of Alternator

Alternators have a crucial role in modern mechanical and electrical systems, providing steady electrical power for a vast array of applications, from automotive to industrial use. This article explores the two types of alternator

most commonly deployed: salient pole alternators and non-salient pole alternators. With the demands for efficiency and reliability continually increasing, understanding the distinguishing features, technical advantages, and applications of these alternator types allows stakeholders to make informed purchasing and engineering decisions. A nuanced analysis of these systems reveals not only their operational differences but also how they are optimized for specific use cases and environments—knowledge pivotal for electrical engineers, procurement managers, and OEM product designers.

Technical Advantages and Performance Metrics

Evaluating alternator types requires a thorough understanding of their technical attributes. Salient pole alternators, characterized by projecting poles and typically used in low and medium-speed applications (usually below 1500 RPM), offer high efficiency at variable loads and excellent cooling performance. Conversely, non-salient pole alternators (also known as cylindrical or round-rotor alternators), predominantly deployed in high-speed applications (above 1500 RPM), exhibit reduced mechanical losses and stable voltage output at high rotational speeds.

The technical edge of non-salient pole alternators stems from their robust construction and reduced windage losses, making them ideal for power plants and large-scale power generation. In contrast, salient pole units excel in hydro-electric setups due to their adaptability to slower engines and superior slip-ring performance. Notably, empirical studies indicate that non-salient alternators can operate at up to 98% efficiency in controlled environments, while salient pole configurations typically achieve 92–95% efficiency, especially when frequent start-stop cycles are involved.

| Attribute | Salient Pole Alternator | Non-Salient Pole Alternator |

|---|---|---|

| Typical Speed Range | < 1500 RPM | > 1500 RPM |

| Efficiency (%) | 92 – 95 | 95 – 98 |

| Cooling Method | Air or hydrogen | Hydrogen or water |

| Best Used For | Hydro-electric, slow turbines | Thermal plants, high-speed turbines |

| Cost | Lower | Moderate to high |

| Maintenance | Requires more frequent inspection | Low maintenance |

Manufacturers Comparison: Data-Driven Insights

Selecting the right type of alternator is often determined by manufacturer competence and the unique innovations integrated within their products. Global industry leaders, such as Siemens Energy, General Electric (GE), ABB, and Leroy-Somer, provide a diverse range of alternator types, each optimized for niche market demands. Siemens, for instance, dominates the high-speed, non-salient alternator segment with an impressive 97% customer satisfaction rating reported in a 2023 industry survey. Meanwhile, ABB's salient pole alternators are renowned for their reliability in harsh environments, evidenced by over 10,000 successful deployments in hydroelectric plants worldwide.

The pricing for OEM alternators can fluctuate significantly based on build quality, incorporated technological advancements, and after-sales support. For example, Leroy-Somer offers modular alternators featuring digital monitoring, which has led to a 12% reduction in operational downtime for European logistics warehouses according to end-user reports. Direct comparison of leading alternator products reveals clear distinctions in technical parameters, warranty periods, and system integration features, as shown in the table below:

| Manufacturer | Leading Product | Alternator Type | Efficiency (%) | Warranty | US Market Price | Special Features |

|---|---|---|---|---|---|---|

| Siemens Energy | SGen-100A | Non-Salient | 97 | 5 years | $48,000 | High-speed, digital monitoring |

| General Electric | Frame 7FH2 | Non-Salient | 95–98 | 4 years | $46,500 | Low vibration design |

| ABB | AMG 500 | Salient Pole | 94–96 | 3 years | $44,800 | Corrosion-resistant, modular |

| Leroy-Somer | LSA 53.2 | Salient Pole | 92–95 | 3.5 years | $42,600 | Compact, easy integration |

Customized Solutions for Various Industries

The selection between different alternator types is rarely arbitrary; it's often driven by specific industry requirements. Marine engineering demands alternators with robust corrosion resistance and consistent output under fluctuating loads; hence, many OEMs opt for salient pole alternators with customized epoxy coatings. For high-performance manufacturing plants, non-salient pole alternators equipped with optimized cooling channels are preferred for continuous, high-speed operations to meet stringent uptime and safety requirements.

Tailoring alternator specifications for industry-specific use cases has become standard among top suppliers. Factors such as voltage regulation, insulation class, automated monitoring integration, and environmental tolerance are frequently adjusted. In one notable case, a leading North American oil & gas corporation implemented custom non-salient pole alternators with Class H insulation to achieve reliable output in extreme heat conditions; maintenance costs dropped by 18% as a direct result. Similarly, a Southeast Asian hydropower plant collaborated with ABB to deploy salient pole units with advanced vibration dampening, ensuring stable power generation even in turbulent operational environments.

Application Cases: Real-World Usage Scenarios

Field application examples underscore the practicality and economic advantage of selecting the appropriate alternator type. In 2022, a German automotive manufacturing plant integrated Siemens Energy’s non-salient pole alternators into its assembly line, achieving a 5% boost in energy efficiency and reducing unscheduled downtime from 45 hours/year to just 10 hours/year. This implementation not only optimized cost per unit but also provided measurable improvements in production stability.

For salient pole alternators, a hydroelectric dam in Brazil utilized Leroy-Somer's LSA 53.2 series, reporting a 20% increase in operational lifespan over earlier models, thanks to superior cooling and maintenance-friendly module design. The successful deployment of alternators tailored to demanding environments demonstrates their resilience and adaptability. These cases substantiate the importance of robust manufacturer partnerships and tailored technical solutions for long-term productivity gains.

| Industry | Alternator Type | Implementation Year | Key Outcome | Performance Gain |

|---|---|---|---|---|

| Automotive (Germany) | Non-Salient | 2022 | Reduced downtime | +5% efficiency; -78% unscheduled downtime |

| Hydropower (Brazil) | Salient Pole | 2020 | Extended component life | +20% operational lifespan |

| Marine (Singapore) | Salient Pole (custom-coating) | 2021 | Improved corrosion resistance | -15% maintenance cost |

| Oil & Gas (Canada) | Non-Salient (Class H insulation) | 2019 | Resilience in extreme heat | -18% maintenance cost |

Maintenance and Optimization Strategies

Sustaining high performance in both types of alternator necessitates strategic maintenance protocols aligned with real-world usage. Predictive diagnostics, leveraging vibration analysis and thermal profiling, now enable facilities to move from interval-based to need-based servicing—a practice that has been shown to decrease total maintenance expenditure by up to 22%. Proactive usage of synthetic lubricants, especially for non-salient pole alternators operating at high RPM, minimizes bearing wear and extends operational hours between overhauls.

Leading alternator manufacturers also suggest utilizing automated cleaning systems, particularly in environments prone to dust or chemical contaminants. For mission-critical installations, remote-monitoring tools and daily electronic log checks contribute to swift fault detection and faster rectifications, limiting the risk of costly interruptions. Comprehensive documentation and adherence to the latest IEC or IEEE standards empower plant engineers to benchmark alternator health and update protocols as new best practices arise.

Conclusion: Innovations Shaping the Future of Alternator Types

Advancements in material science, digital monitoring, and predictive maintenance are fostering significant shifts in the landscape of alternator types. With the ongoing push toward sustainability and efficiency, the distinction between the two types of alternator—salient pole and non-salient pole—is expected to blur as hybrid designs and new rotor configurations emerge. Data-driven decision-making, based on industry case studies and robust technical comparisons, remains essential for optimizing deployment strategies.

Manufacturers invest heavily in R&D to introduce alternators with greater efficiency, longer service intervals, and real-time health insights. These innovations will continue to enhance the adaptability and longevity of both types, supporting energy transition initiatives and expanding market opportunities across sectors such as transportation, manufacturing, and renewable energy. Ultimately, understanding the strengths and evolving applications of alternator types will empower organizations to stay at the forefront of power generation technology in the years ahead.

(two types of alternator)